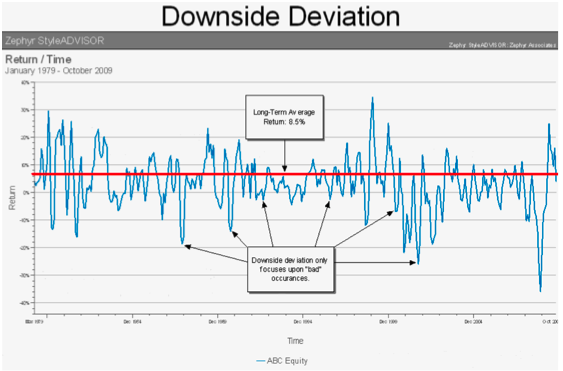

Negative Return

Negative return or downside risk can be used to describe the exact same thing. These terms basically indicate that investments will not make money if they don't perform well over a period of time. Exumor Chanels Inc. might lose 6% if it falls apart.

This study, which uses high-frequency data, shows that the effects of negative returns are larger in emerging markets than in developed markets. However, this doesn't mean that downside risk is less of a concern in all markets. Rather, the study shows that negative returns and downside risks are more of a concern in emerging markets, which is why negative return and downside risk expectations should be evaluated carefully before investing in any type of investment.

Capital loss

A downside is a financial risk when you invest in a security which may lose its worth. This risk can be finite or infinite. Roy first examined this risk in 1952. He used his theory to predict the possible losses in securities. When deciding whether to buy a security, you should consider its potential downside risk.

A downside risk can be managed in many ways. Diversification and tactical asset allocation are three of the most common ways to reduce downside risk. These strategies should be tailored for the time and risk tolerance of each investor. They must also be consistent with the cost involved.

Inflation

Inflation is on the verge of falling for the first time since last year. The Federal Reserve is unlikely to raise interest rates as high as market expectations. It has only raised interest rate once this year. In fact, communication from the Fed about future hikes has already caused mortgage yields and Treasury yields both to rise. It is probable that the Fed will raise rates slowly, which will allow inflation to remain manageable.

The downside to inflation is the possibility of consumer spending being cut, which could be detrimental to economic growth. Consumers will find it harder to buy fun goods if the price of staples increases. This could lead the economy to slow down and the stock exchange to decline.

Volatility

Volatility and downside risk are two important concepts in investing. When investing, one needs to reduce the downside risk and maximize the upside. The volatility of the market simply means that a security's risk level is measured. This is also known as the "risk of losing money". In addition, volatility refers to how much risk an investment may have before it is fully realized.

If the investment's value drops, there is a risk that investors might lose their money. This risk can easily be calculated in several ways. This is the most popular way to calculate risk. It involves comparing upside potential and downside risk. Upside potential is the chance that the value of a security will increase over time.

Liquidity

Trading involves two types of risk. Market liquidity risk is the first. This risk is caused by market withdrawals. Another type of risk is the downside risk. While an asset's price may drop to zero, it could also rise above its listing price when the market recovers. These two risks can negatively affect your profits and losses.

Funding liquidity risks are a risk that a business may not be capable of meeting its cash flow demands in the future, or its current cash need. This risk can materially impact the operation of a firm. This is particularly problematic for financial companies. Implementing debt maturity conversion is one option to mitigate this risk.

FAQ

What do we mean when we say "project management"?

Management is the act of managing activities in order to complete a project.

We help you define the scope of your project, identify the requirements, prepare the budget, organize the team, plan the work, monitor progress and evaluate the results before closing down the project.

What is a simple management tool that aids in decision-making and decision making?

The decision matrix is a powerful tool that managers can use to help them make decisions. It helps them think systematically about all the options available to them.

A decision matrix can be used to show alternative options as rows or columns. This makes it easy for you to see how each option affects other options.

This example shows four options, each represented by the boxes on either side of the matrix. Each box represents an option. The top row displays the current situation, and the bottom row shows what might happen if nothing is done.

The effect of choosing Option 1 can be seen in column middle. In this case, it would mean increasing sales from $2 million to $3 million.

The following columns illustrate the impact of Options 2 and 3. These positive changes can increase sales by $1 million or $500,000. These positive changes have their downsides. Option 2 can increase costs by $100 million, while Option 3 can reduce profits by $200,000.

The last column shows you the results of Option 4. This involves decreasing sales by $1 million.

The best thing about a decision matrix is the fact that you don't have to remember which numbers go with what. You just look at the cells and know immediately whether any given a choice is better than another.

This is because the matrix has already taken care of the hard work for you. It is as simple a matter of comparing all the numbers in each cell.

Here's an example of how you might use a decision matrix in your business.

You need to decide whether to invest in advertising. By doing so, you can increase your revenue by $5 000 per month. You will still have to pay $10000 per month in additional expenses.

If you look at the cell that says "Advertising", you can see the number $15,000. Advertising is a worthwhile investment because it has a higher return than the costs.

How can a manager improve his/her managerial skills?

It is important to have good management skills.

Managers need to monitor their subordinates' performance.

If you notice your subordinate isn't performing up to par, you must take action quickly.

You should be able pinpoint what needs to improve and how to fix it.

What is the difference of leadership and management?

Leadership is about inspiring others. Management is about controlling others.

Leaders inspire others, managers direct them.

Leaders motivate people to succeed; managers keep workers on track.

A leader develops people; a manager manages people.

Statistics

- Our program is 100% engineered for your success. (online.uc.edu)

- The average salary for financial advisors in 2021 is around $60,000 per year, with the top 10% of the profession making more than $111,000 per year. (wgu.edu)

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

- This field is expected to grow about 7% by 2028, a bit faster than the national average for job growth. (wgu.edu)

- UpCounsel accepts only the top 5 percent of lawyers on its site. (upcounsel.com)

External Links

How To

How can you implement the Kaizen technique?

Kaizen means continuous improvement. The term was coined in the 1950s at Toyota Motor Corporation and refers to the Japanese philosophy emphasizing constant improvement through small incremental changes. It's where people work together in order to improve their processes constantly.

Kaizen is one of Lean Manufacturing's most efficient methods. Employees responsible for the production line should identify potential problems in the manufacturing process and work together to resolve them. This will increase the quality and decrease the cost of the products.

The main idea behind kaizen is to make every worker aware of what happens around him/her. So that there is no problem, you should immediately correct it if something goes wrong. If someone is aware of a problem at work, he/she should inform his/her manager immediately.

Kaizen has a set of basic principles that we all follow. Start with the end product, and then move to the beginning. In order to improve our factory's production, we must first fix the machines producing the final product. First, we fix machines that produce components. Next, we fix machines that produce raw material. We then fix the workers that work with those machines.

This is why it's called "kaizen" because it works step-by-step to improve everything. Once we have finished fixing the factory, we return to the beginning and work until perfection.

To implement kaizen in your business, you need to find out how to measure its effectiveness. There are many ways to tell if kaizen is effective. Another way to determine if kaizen is working well is to look at the quality of the products. Another way is to see how much productivity has increased since implementing kaizen.

A good way to determine whether kaizen has been implemented is to ask why. Did you do it because it was legal or to save money? Did you really believe that it would be a success factor?

If you answered yes to any one of these questions, congratulations! You're ready to start kaizen.